China

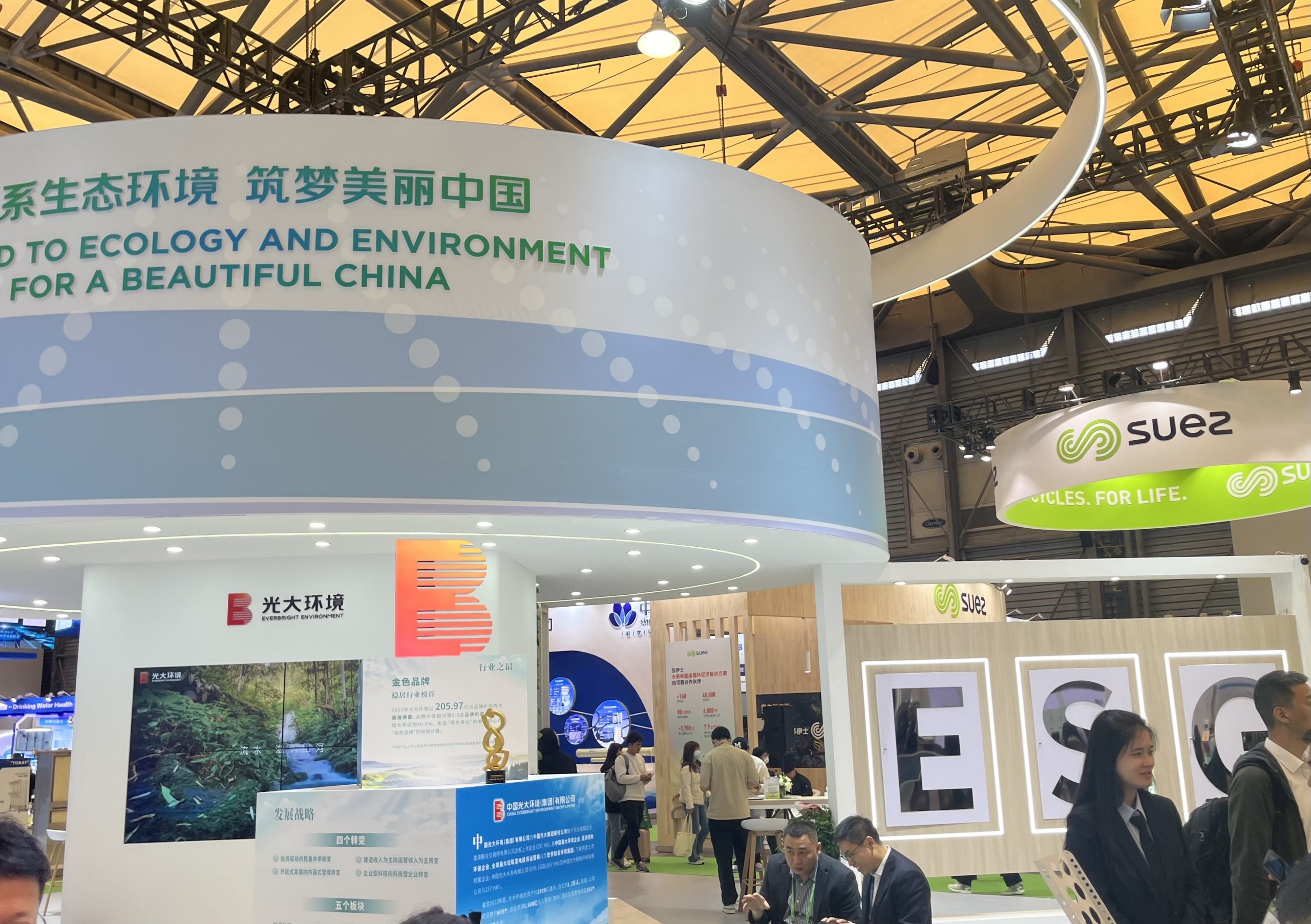

Photo taken at IE Expo China 2024, International Trade Fair for Environmental Technology Solutions, Shanghai April 2024

Our work in China

Humanity faces a triple planetary crisis – climate change, environmental pollution, and biodiversity loss. International governments have advocated for the importance of green transition – a shift towards environmental and climate-friendly economic development. The shift is particularly driven by a logic of decoupling that aims to reduce the environmental and climate footprint while maintaining economic growth. Subsequently, a range of policies, tools, and goals such as the EU taxonomy and the United Nations Sustainable Development Goals emerged to facilitate green transition, among which Environmental, Social and Corporate Governance (ESG) reporting; the latter has attracted a significant amount of attention due to its promises in monitoring and generating concrete relevant data from business performance.

Information about a company’s ESG (Environmental, Social and Governance) performance, that is, ESG data, especially serves as a critical compass for companies, investors, and other stakeholders to evaluate the sustainability and ethical impact of a business, influencing investment decisions and corporate practices. The emphasis on ESG data in steering green transition speaks to the logic of decoupling, where IT is seen as an important component of the green transition.

China stands out as an interesting case in the development of ESG and the cultivation of ESG data. As an emerging key player in global governance for sustainable development, China has a significant influence in shaping the future landscape of green investment and business practices. Overall, the Chinese government has ambitions to green digital transition. Internationally, it has issued policy for promoting green oversea business and investment under the Belt and Road Initiative. Domestically, it has announced the ‘dual carbon’ policy, aiming for achieving peak emission by 2030 and carbon neutrality by 2060.

ESG data is envisioned to play a critical role in implementing, monitoring, and evaluating such governmental claims and polices. However, emerging global politics and competing policy concerns have also presented challenges for China’s ESG development and green transition. In the face of global energy shortages, market instability, and geopolitical tensions, China and other major economies are increasingly prioritizing security in various forms – e.g., energy security, food security and supply chain security. Furthermore, the increasing geopolitical tensions and the dominant narratives on the great power rivalry have created a tendency towards protectionism, polarization, and de-globalization, challenging the existing world order.

“Situated in this context, I explore several dimensions on sustainability and the green digital transition, particularly regarding ESG data. More specifically, I investigate how ESG data practices are practically implemented locally and at the grassroot level, such as by non-government organizations (NGOs); how ESG practitioners and local communities perceive ESG related issues (such as climate change) they are dealing with and understand the role of ESG data and related technologies in mitigating these issues; and how bottom-up ESG initiatives interplay with top-down ESG policy implementations through interaction with public and private actors. My project provides invaluable insights on the local manifestations of the decoupling logic in China and on the ongoing sociocultural change evolving in the spaces of climate change, IT, and capitalism, as well as on the human-nature-technology relationship”

– Vivian Wei Guo

Researchers Working on this Subproject

Vivian Wei Guo

Cancan Wang